property tax rates philadelphia suburbs

2 Suburbs with the Lowest Cost of Living in Philadelphia Area. Philadelphia County is located in Pennsylvania.

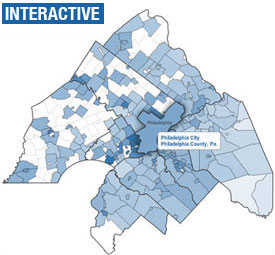

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

It is close enough to all local stores safe community and a great place to raise your children.

. After completeing your selections search for a town or county above or click on a town in the map below. Property taxes in Philadelphia County are collected at a rate of 091 percent of the assessed fair market value of a property on average. Submit a service request with 311.

The property tax rate in Philadelphia is. It is close enough to all local stores safe community and a great place to raise your children. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment.

Searching Up-To-Date Property Records By County Just Got Easier. The combined percentage is 32275040 percent. Lets say four area comparable houses sold for 1M recently but the disputed property with 100K in wind damage now has a 900K adjusted valuation.

The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Find All The Record Information You Need Here. Rochester NY has a few different taxes that people must pay including city school county and water.

Philadelphias property tax system will change in 2013 if City Council and the mayor follow through. Pennsylvania Property Tax Calculator Smartasset Sparing Philadelphia Homeowners From Increasing Property Tax Burdens Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts Related. The rate is on 11000 of a dollar.

Effective property tax rates on a county basis range from 091 to 246. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a.

Overall Pennsylvania has property tax rates that are higher than national averages. Now consider you live in the suburbs but also work in a Philadelphia suburb. Ad Unsure Of The Value Of Your Property.

Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a median value of 135200. Comparing the Tax Burden in Philadelphia and the Suburbs Select a year income level and household type. If Philadelphia property tax rates have been too high for you resulting in delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Philadelphia PA.

The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. Erty taxes in some suburbs falling wage taxes in Philadelphia and undervalued property assessments in Philadelphia compared to suburbs where assessments more closely reflected rising home values through most of the 12-year period. Get help paying your utility bills.

Milford Square is a great place to live. Compare Tax Burdens in the Philly Region. 3 Best Suburbs to Buy a House in Philadelphia Area.

Track a service request with 311. Get home improvement help. The city taxes are 06206 percent school tax is 13939 percent county is 107898862 and water is 1340178.

Get help with deed or mortgage fraud. Report a problem with a building lot or street. Request a circular-free property decal.

In fact the state carries a 150 average effective property tax rate in comparison to the 107 national average. Buy sell or rent a property. That rate applied to a home worth 239600 the county median would result in an annual property tax bill of 5075.

For the 2022 tax year the rates are. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of. Milford Square is a great place to live.

It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation. Then choose a municipality or county. According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent.

The Tax Foundation study was based on median property taxes paid within counties in 2018 based on five-year estimates. Property tax rates philadelphia suburbs Wednesday June 8 2022 Edit.

Philly City Council Reaches Budget Deal With Tax Relief Whyy

City Council To Consider Competing Tax Relief Measures Whyy

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America

Why Are Residential Property Tax Rates Regressive

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

Residential Taxes A Narrowing Gap Between Philadelphia And Its Suburbs The Pew Charitable Trusts

Philadelphia County Pa Property Tax Search And Records Propertyshark

Mcelroy For Sale Philadwellphia Com

Moving In Philadelphia Guide To Philadelphia Neighborhoods

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

Philadelphians Views On The Taxes They Pay And How The City Spends Those Dollars The Pew Charitable Trusts

2022 Best Philadelphia Area Suburbs To Buy A House Niche

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

/cloudfront-us-east-1.images.arcpublishing.com/pmn/VZQXKD2DQBBDLOVHNFHXVCYERE.jpg)

Where Philadelphia Ranks Among Cities With The Fastest Growing Property Taxes In America

Home Ownership Matters Frustrated Residents Want Transparency Accuracy In Philadelphia Property Assessment Procedure

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year